Despite continued global instability in 2024, the global projector market maintained an upward trend. According to data from RUNTO, global projector market shipments reached 20.167 million units in 2024, a year-on-year increase of 7.5%; sales revenue was $9.27 billion, a year-on-year decrease of 6.2%.

The global market's robust development is mainly due to the following factors:

First, improved macroeconomic environment and effective relief of inflationary pressure have boosted consumer confidence, with projection devices as premium consumer products showing a clear positive response;

Second, accelerated generational shift in consumer groups, with Generation Z continuing to deepen their understanding of emerging display technologies and devices;

Third, the prominence of sports economy effects, with concentrated sporting events such as the Olympics, Copa América, and European Championship creating bidirectional demand in both home entertainment and commercial display sectors;

Fourth, deepening restructuring of global supply chains, with Chinese projection enterprises playing a larger role due to their technological iteration capabilities and manufacturing cost advantages;

Fifth, the rapid expansion of cross-border e-commerce platforms and overseas social e-commerce provide strong support for domestic projection brands to expand global market sales channels and build new marketing matrices.

Home Market is the Main Growth Point

By scenario, the strong growth in the home projector market contrasts sharply with the significant decline in the commercial projector market.

Home projectors maintained growth through technological innovation, product upgrades, price advantages, and scenario expansion. According to data from RUNTO, in 2024, the home projector market shipments reached 17.345 million units, a year-on-year increase of 13.0%, accounting for over 85% of the overall global market.

In the commercial projector market, on one hand, demand for corporate procurement and engineering projects decreased due to the macroeconomic environment; on the other hand, large-sized LED displays exerted pressure on engineering projection products; the continued price decline of large-sized educational and commercial interactive panels, newly emerging conference television products, as well as cross-scenario applications of home products all created strong competitive pressure on commercial and educational projectors.

In 2024, global commercial projector market shipments were 2.822 million units, a year-on-year decrease of 17.2%.

Global Projector Market

Quarterly Shipments by Scenario

Data source: RUNTO, Unit: K

XGIMI Leads Global Home Projector Market for Consecutive Year

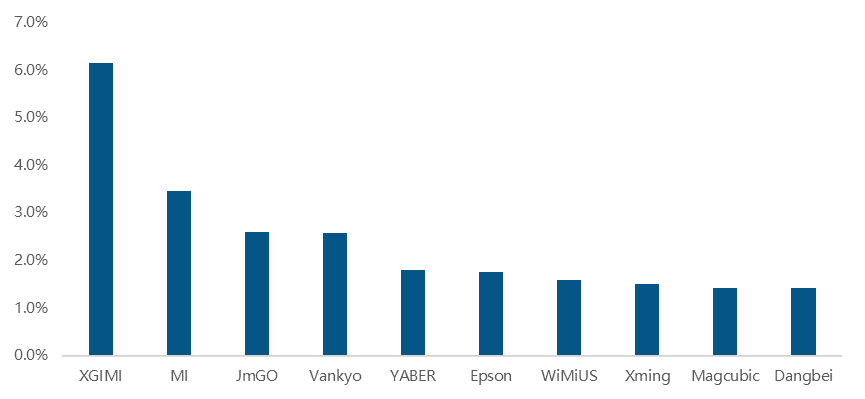

XGIMI maintains its leading position in the global home projector market. A According to data from RUNTO, in 2024, XGIMI's shipment share in the global home projector market reached 6.2%, ranking first; second and third places were also occupied by Chinese mainland brands Xiaomi and JmGO.

XGIMI's global strategy is reflected in three dimensions: First, deep localization, optimizing product design through precise consumer insights, such as simplifying control interfaces for Southeast Asia and launching products that integrate with home aesthetics in Japan, while establishing local teams and cooperation networks with international retailers (Amazon, BestBuy).

Second, technological moat, with XGIMI's proprietary Dual Light 2.0 light source technology receiving EISA international certification, and self-developed optical engine systems ensuring supply chain resilience.

Third, omni-channel marketing matrix, leveraging crowdfunding models to leverage the US market online, while utilizing international exhibitions and KOL collaborations offline, and strengthening brand influence through global events such as the Paris Olympics.

Market Share of Major Brands

in the Global Home Projector Market, 2024

Data source: RUNTO, Unit: %

Global Projector Shipments Expected to Exceed 22 Million Units in 2025

In 2025, the global situation remains complex and variable. On one hand, economic recovery provides growth momentum for the market, but external factors such as trade barriers and geopolitical conflicts affect market demand and supply chain stability.

The most influential factor is undoubtedly the tariff policy implemented by the new US government. Starting March 2025, the US imposed an additional 10% tariff on imported goods from China, effectively raising it to 20%, directly increasing the import cost of projection equipment, ultimately passing to American consumers. Additionally, the fluctuating US tariff exemption policy for packages under $800 has also significantly impacted cross-border e-commerce.

On the other hand, there are positive signals: breakthroughs in domestic projector technology, high-end advancements in laser light sources, the emergence of new regional markets, and the global expansion of Chinese brands. The most fundamental factor is that trends toward larger screens, higher definition, immersive experiences, and intelligence are irreversible, with development momentum existing long-term in both home and commercial markets.

RUNTO forecasts that in 2025, the global projector market shipments are expected to reach 22.08 million units, a year-on-year increase of 9.5% compared to 2024.

Keyword: AIoT

© 2019 Beijing Runto Technology Co., LTD. All rights reserved. 京ICP备19053604号-1

Wonderful reviews