By 24:00 on February 4, 2020, the health and fitness commission and the center for disease control and prevention announced the distribution of cumulative confirmed cases of pneumonia with new coronavirus infection in China .It can be seen that the province of Hubei, the source of the epidemic, is the most serious.The next provinces with the most severe outbreaks were Zhejiang, Guangdong, Henan, Hunan, Jiangxi and Anhui, all of which had more than 500 confirmed cases.

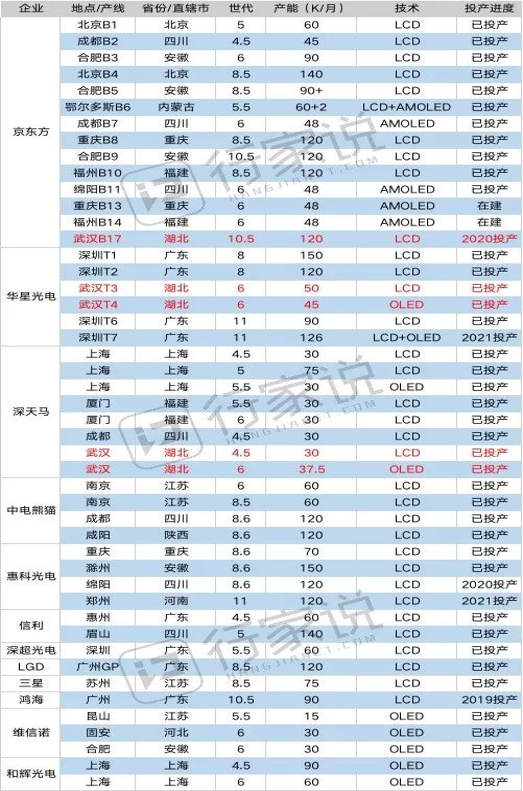

So what is the impact of this outbreak on panel capacity? Let's take a look at the distribution of the main panel production lines in China.

Wuhan, the epicenter of the outbreak, has five main panel production lines. Boe's 10.5 generation line completed the capping of the main structure in November last year and will be put into mass production at the beginning of 2020 with a designed capacity of 120K/ month. Huaxin optoelectronics has a 6-generation LTPS/IGZO/AMOLED production line, and another 6-generation/soft/AMOLED production line. Shenzhen TM's 4.5 generation a-si LCD production line and 6 generation soft AMOLED plant, Wuhan is regarded as the key town of technology components in mainland China.

As the largest production center of panel factories in mainland China, Guangdong, the number and scale of panel factories have surpassed that of the later Wuhan, and the cumulative number of epidemic cases now ranks among the top in China. The impact of the epidemic on the production capacity of Guangdong cannot be ignored. CSOT optoelectronics has two 8.5 generation plants and two 10.5 generation plants in Shenzhen. LGD's 8.5 generation plant in Guangzhou; Together with hon hai's super sakai 10.5 plant in Zengcheng, Guangzhou, and the fifth generation plant in Shenzhen and the 4.5 sub-plant in Huizhou, Guangdong has a total of eight panel factories, making it the largest panel factory cluster in mainland China.

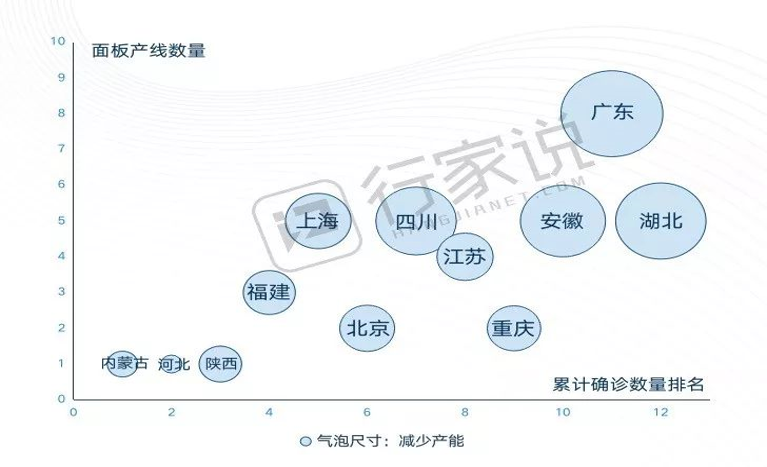

Under the epidemic prevention measures, the number of working days in China's panel factories decreased in February, which is estimated to have an impact on the dynamic rate of panel factories in mainland China by 15-20 percentage points. To sum up, the provinces/municipalities with panel production lines were ranked in terms of the number of confirmed outbreaks. Combined with the number of production lines, the panel plant dynamic rate was conservatively reduced by 15%, and the panel production loss in mainland China was integrated as follows (excluding the upcoming production capacity of Wuhan BOE 10.5) :

Note that the horizontal axis above is a comparative ranking of the number of confirmed outbreaks, not a quantitative ranking. As of February 4, the number of confirmed cases in Hubei was two orders of magnitude higher than that of the second-tier provinces, so the difference between the two provinces in terms of quantitative ranking was much larger than that shown in the figure. An outbreak can create uncertainty about future production, such as raw material supplies and staff returning to work. Therefore, the horizontal axis can be regarded as an uncertainty comparison, while the vertical axis is the number of production lines and the bubble size is the panel output reduction. So the more you go to the right, the more uncertainty you have about the future, and the more you go up, the more impact you have on the production line, the bigger the bubble, the more you expect to lose production. Therefore, the situation in the upper right corner is the most unfavorable.

Guangdong, Hubei and Anhui provinces are located in the upper right corner, and the production is affected by the epidemic. At present, the total panel production capacity of Guangdong is 690K/ month, and the output is reduced by about 103.5k/month based on a 15% drop in the dynamic rate. Hubei has a total panel capacity of 162.5k/month, which IHS estimates will be cut in half, leaving a reduction of about 81.25k/month. Anhui's panel production capacity totaled 480K/ month, which was reduced by about 72K/ month based on a 15% drop in the dynamic rate. To sum up, the total panel production capacity in mainland China is 3,040.5k/month, with a total reduction of about 512.95k/month. But the premise here is that the epidemic will not further outbreak across the country, especially in Guangdong province to prevent and control the epidemic, for the panel production capacity is very critical.

In Guangdong, the largest proportion of panel production capacity is 8, 11 and 8.5 generation line; in Hubei, the largest proportion is 4.5 generation line and the soon-to-be put into production BOE 10.5 generation line; in Anhui, the largest proportion is 8.6 generation line. Combined with the above table, the panels under 55 ", 65 "and 75" were produced in Guangdong, which were mainly used for TV. In Hubei, it mainly affects the output of panels below 12.1 ", 65 "and 75", which are mainly used in laptop, automotive panel and TV; Anhui is mainly under 55 "panel, also mainly used for TV.

It can be seen that the panel capacity corresponding to the epidemic for TV has a greater impact .According to industry estimates, downstream TV machine factory to ensure smooth shipment, has begun to the panel factory add order "grab order" big battle, estimated TV panel this season up 5 to 6 dollars.

nter for disease control and prevention announced the distribution of cumulative confirmed cases of pneumonia with new coronavirus infection in China .It can be seen that the province of Hubei, the source of the epidemic, is the most serious, with a cumulative total of 16,678 confirmed cases, 18,447 suspected cases and 479 deaths by 24:00 on February 4, 2020.The next provinces with the most severe outbreaks were Zhejiang, Guangdong, Henan, Hunan, Jiangxi and Anhui, all of which had more than 500 confirmed cases.

So what is the impact of this outbreak on panel capacity? Let's take a look at the distribution of the main panel production lines in China.

Wuhan, the epicenter of the outbreak, has five main panel production lines. Boe's 10.5 generation line completed the capping of the main structure in November last year and will be put into mass production at the beginning of 2020 with a designed capacity of 120K/ month. Huaxin optoelectronics has a 6-generation LTPS/IGZO/AMOLED production line, and another 6-generation/soft/AMOLED production line. Shenzhen TM's 4.5 generation a-si LCD production line and 6 generation soft AMOLED plant, Wuhan is regarded as the key town of technology components in mainland China.

As the largest production center of panel factories in mainland China, Guangdong, the number and scale of panel factories have surpassed that of the later Wuhan, and the cumulative number of epidemic cases now ranks among the top in China. The impact of the epidemic on the production capacity of Guangdong cannot be ignored. CSOT optoelectronics has two 8.5 generation plants and two 10.5 generation plants in Shenzhen. LGD's 8.5 generation plant in Guangzhou; Together with hon hai's super sakai 10.5 plant in Zengcheng, Guangzhou, and the fifth generation plant in Shenzhen and the 4.5 sub-plant in Huizhou, Guangdong has a total of eight panel factories, making it the largest panel factory cluster in mainland China.

Under the epidemic prevention measures, the number of working days in China's panel factories decreased in February, which is estimated to have an impact on the dynamic rate of panel factories in mainland China by 15-20 percentage points. To sum up, the provinces/municipalities with panel production lines were ranked in terms of the number of confirmed outbreaks. Combined with the number of production lines, the panel plant dynamic rate was conservatively reduced by 15%, and the panel production loss in mainland China was integrated as follows (excluding the upcoming production capacity of Wuhan BOE 10.5) :

Note that the horizontal axis above is a comparative ranking of the number of confirmed outbreaks, not a quantitative ranking. As of February 4, the number of confirmed cases in Hubei was two orders of magnitude higher than that of the second-tier provinces, so the difference between the two provinces in terms of quantitative ranking was much larger than that shown in the figure. An outbreak can create uncertainty about future production, such as raw material supplies and staff returning to work. Therefore, the horizontal axis can be regarded as an uncertainty comparison, while the vertical axis is the number of production lines and the bubble size is the panel output reduction. So the more you go to the right, the more uncertainty you have about the future, and the more you go up, the more impact you have on the production line, the bigger the bubble, the more you expect to lose production. Therefore, the situation in the upper right corner is the most unfavorable.

Guangdong, Hubei and Anhui provinces are located in the upper right corner, and the production is affected by the epidemic. At present, the total panel production capacity of Guangdong is 690K/ month, and the output is reduced by about 103.5k/month based on a 15% drop in the dynamic rate. Hubei has a total panel capacity of 162.5k/month, which IHS estimates will be cut in half, leaving a reduction of about 81.25k/month. Anhui's panel production capacity totaled 480K/ month, which was reduced by about 72K/ month based on a 15% drop in the dynamic rate. To sum up, the total panel production capacity in mainland China is 3,040.5k/month, with a total reduction of about 512.95k/month. But the premise here is that the epidemic will not further outbreak across the country, especially in Guangdong province to prevent and control the epidemic, for the panel production capacity is very critical.

In Guangdong, the largest proportion of panel production capacity is 8, 11 and 8.5 generation line; in Hubei, the largest proportion is 4.5 generation line and the soon-to-be put into production BOE 10.5 generation line; in Anhui, the largest proportion is 8.6 generation line. Combined with the above table, the panels under 55 ", 65 "and 75" were produced in Guangdong, which were mainly used for TV. In Hubei, it mainly affects the output of panels below 12.1 ", 65 "and 75", which are mainly used in laptop, automotive panel and TV; Anhui is mainly under 55 "panel, also mainly used for TV.

It can be seen that the panel capacity corresponding to the epidemic for TV has a greater impact .According to industry estimates, downstream TV machine factory to ensure smooth shipment, has begun to the panel factory add order "grab order" big battle, estimated TV panel this season up 5 to 6 dollars.

Keyword: Panel

© 2019 Beijing Runto Technology Co., LTD. All rights reserved. 京ICP备19053604号-1

Good Comments